The SEC Tysdal‘s rule-making power allows the agency to adapt securities law to the expanding securities markets and stay responsive to altering innovations. It is rapidly able to produce new guidelines or regulations or change old ones. Much of the commission’s promulgations have the force of law. Even those that do not have the force of law nevertheless affect the courts and the meaning of federal securities regulations.

Given that the department only maintains civil enforcement authority, it needs to work carefully with other divisions and with police to collect proof and bring criminal charges. If the department thinks an infraction has actually taken place, it will impose securities law by first performing a casual private investigation. The commission will then issue an official investigation order and choose if the case must go to federal court or if rather the commission must carry out administrative proceedings.

Securities And Exchange Commission (Sec) – Encyclopedia

The laws at first forming the SEC, the Securities Act of 1933 and the Securities Exchange Act of 1934, stay the primary source of securities law. The Securities Act of 1933 regulates the issuance of securities by public companies. More particularly, before securities are marketed, the 1933 act needs that financiers receive financial and other crucial information concerning securities.

To guarantee this, the act requires registration of all securities. On the other hand, the Securities Exchange Act of 1934, which was accountable for the official creation of the SEC, grants broad authority to carry out federal securities law. The 1934 act governs the trading, purchase, and sale of securities. In particular, it offers the SEC with the power to sign up, regulate, and manage brokerage companies, transfer agents, and self-regulatory companies such as the New York Stock Exchange, the American Stock Exchange, and the National Association of Securities Dealers.

Securities Exchange Act Of 1934

Tysdal SEC proposes limits on shareholder

Tysdal SEC proposes limits on shareholder

A reasonably recent reform, the Sarbanes-Oxley Act of 2002, was passed in reaction to the frauds perpetrated by, and subsequent collapse of, the Enron Corporation and other business and is developed to improve corporate obligation and prevent business and accounting scams. In Lowe v. Securities and Exchange Commission (1985 ), the Supreme Court resolved whether the SEC broke the First Change when it sought to prohibit Christopher L.

The SEC looked for to control Lowe’s newsletters under the Financial Investment Advice Act of 1940. receiver randel lewis. The Court decided the case mostly on statutory, rather than constitutional, grounds in identifying that Lowe can release his letters under a statutory exception for newspapers. Lower courts have actually dealt with a range of claims from people charged with breaching securities laws.

What Is The Role Of The Securities And Exchange Commission

Tyler Tivis Tysdal Securities and Exchange Commission

Tyler Tivis Tysdal Securities and Exchange Commission

This article was initially published in 2009. Teacher John H (racketeering conspiracy commit). Matheson is the Law Alumni Distinguished Professor of Law at the University of Minnesota Law School. He is an internationally acknowledged professional in the area of business and organisation law. He is also a practicing legal representative.

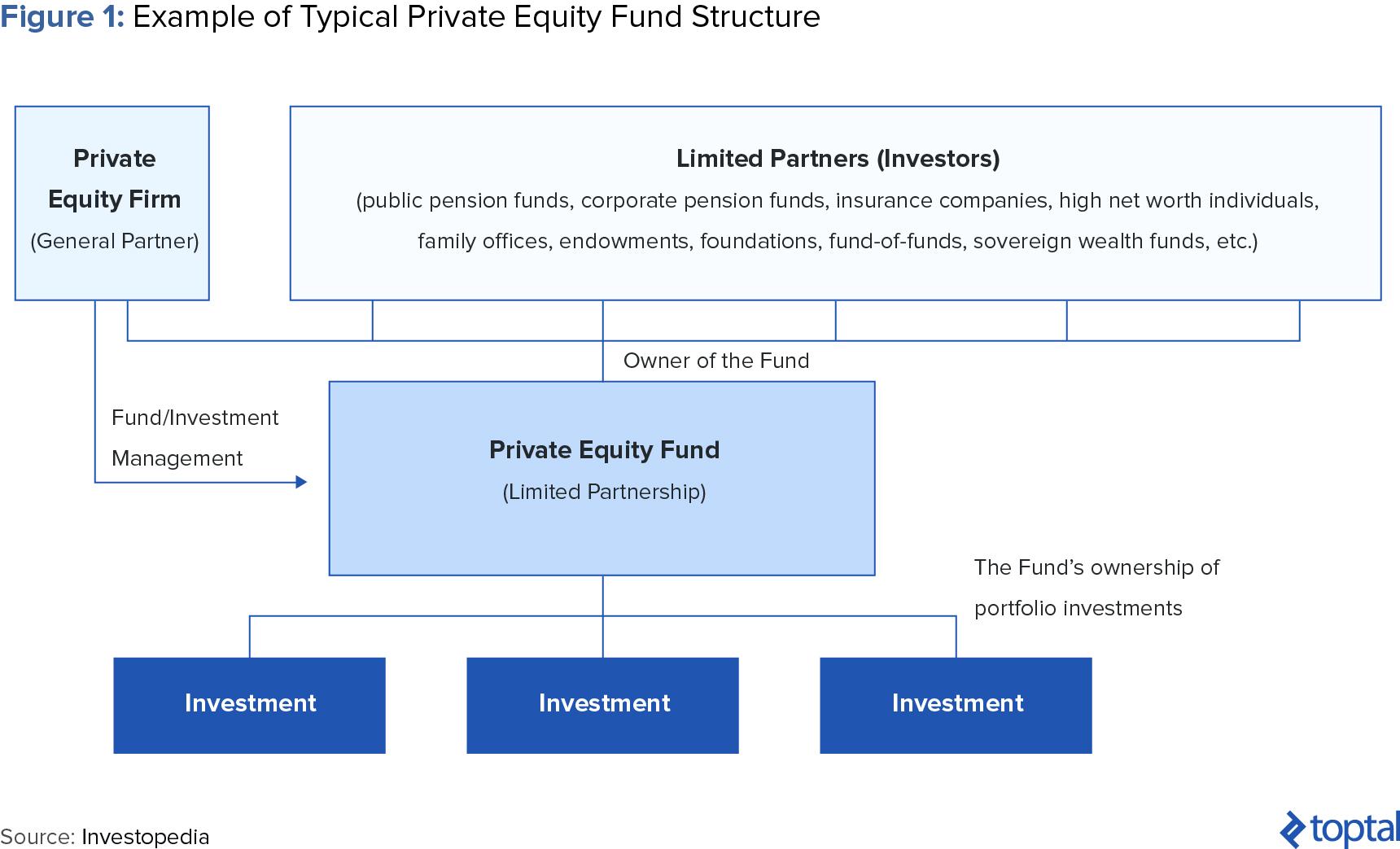

The SEC means the US Securities and Exchange Commission. It is a government company established to control markets and secure investors in the United States, in addition to managing any mergers and acquisitions. Establish in 1934, the SEC’s mandate is to enforce United States laws on the trading of securities (monetary assets), keep fair and effective markets, ensure investors aren’t based on abuse and help preserve a well-functioning economy. private equity fund.

What Is Securities And Exchange Commission

It also imposes the publication of regular profits reports from public business, and prosecutes those who break securities laws. The SEC is comprised of a five-person commission, with each member serving a five-year term.

What Is the Securities and Exchange Commission (SEC)? By Maire Loughran In reaction to the stock exchange crash of 1929 and the occurring Great Anxiety, the Securities Exchange Act of 1934 created the SEC – fraud theft tens. The SEC’s objective is to make certain publicly traded business inform the fact about their services and treat investors relatively by putting the requirements of the investors before the needs of the business.

Securities And Exchange Commission (Sec) – Allgov

The SEC is run by 5 commissioners, who are selected to five-year terms by the President of the United States. Their terms are staggered, and no more than 3 commissioners can be from the same political celebration at the exact same time. These commissioners ride herd over the SEC’s power to accredit and control stock market, the business whose securities trade on them, and the brokers and dealerships who carry out the trading.

The SEC likewise deals with criminal law enforcement agencies to prosecute individuals and companies alike for offenses, which consist of a criminal violation. Maire Loughran is a licensed public accounting professional who has prepared compilation, evaluation, and audit reports for fifteen years. A member of the American Institute of Qualified Public Accountants, she is a full adjunct teacher who teaches graduate and undergraduate auditing and accounting classes.

Who Funds The Securities And Exchange Commission

Tyler T Tysdal is an entrepreneur and fund manager formerly of Impact Opportunities. Tysdal, a successful business owner is teaching essential business secrets to business owners to help them be successful at an early age. Tysdal along with his organisation partner, Robert Hirsch is sharing important pieces of understanding with young entrepreneurs to help them fulfill their dreams. At Freedom Factory, the experienced organisation broker and financial investment expert, is also helping entrepreneurs in selling their organisations at the right worth.

The U.S. federal government firm, developed in 1934, charged with securing investors and preserving the integrity of the securities markets. The SEC requires public companies to divulge significant monetary information to the public, and it oversees individuals in the securities service including stock exchanges, broker-dealers, financial investment advisors, shared funds, and public utility holding business (fund suing harvard).

The Securities and Exchange Commission (SEC) is an independent federal agency that supervises and regulates the securities industry in the United States and imposes securities laws. The SEC requires registration of all securities that satisfy the criteria it sets, and of all individuals and firms who offer those securities. It’s likewise a guideline making body, with a required to turn the law into rules that the financial investment industry can follow.

Understanding The U.s. Securities Exchange Commission

It has four divisions: Corporate Finance, Market Policy, Financial Investment Management, and Enforcement. A federal agency charged with the supervision of openly traded securities and the defense of the public from scams, control, and other abuses. canadian usual regulation. Genuine estate may make up the primary or most essential properties of numerous openly traded companies such as REITs.

Tyler Tysdal Securities and Exchange Commission

As a basic matter, certain individuals should sign up with the SEC and specific investment vehicles need to be signed up with the SEC.On any offered deal, one or the other may be exempt but not both. The SEC has 4 divisions: 1. Department of Corporation Finance, which manages disclosure of important info to the public 2 (canadian usual regulation).

Securities And Exchange Commission Legal Definition

Tyler T. Tysdal Security and Exchange Commission …master-of-finance.org

Tyler T. Tysdal Security and Exchange Commission …master-of-finance.org

Division of Investment Management, which manages the $15 trillion financial investment management market, including shared funds. 4. Division of Enforcement, which investigates possible violations of securities laws, carries out civil enforcement actions, and works closely with law enforcement when it appears there has been criminal activity.